Learning More About Colorado’s Education Industry

An analysis featuring labor market characteristics, trends, and statistics for a key sector in the state

Note: due to the length of this article, it may truncate when received via email. Visit this link if you run into those issues: https://ryangedney.substack.com/archive.

The education industry serves an extremely valuable function in society, as it tasked with informing and instructing individuals of all different ages, backgrounds, and socioeconomic statuses. In Colorado, approximately 1 out of 12 jobs are concentrated within education. This article will highlight employment and wage statistics for Colorado’s education industry.

Part I: Employment Characteristics for Colorado’s Education Industry

In 2023, there were around 236,000 jobs within the state’s education sector, which represented 8.2% of total industry employment. The table below displays how those 236,000 jobs were allocated by detailed industry and ownership (i.e. government type or private sector). The vast majority of educational employment in Colorado – nearly 60% – falls within the local government elementary and secondary schools category, otherwise known as public K-12. The next largest share (17.6%) of employment goes towards state government colleges, universities, and professional schools, like Colorado State University and the University of Colorado. A little over 17% of Colorado’s educational employment, or 41,000 jobs, resides within the private sector, with the biggest proportions dedicated to other schools and instruction; colleges, universities, and professional schools; and elementary and secondary schools. Finally, the remaining allocation is either in state or local junior colleges (4%) or the federal government (0.5%).

Colorado’s share of educational employment within the private sector has risen steadily over the past 30+ years, but is notably lower than the U.S., which has been a consistent difference over that period. Relative to 47 other states with comparable data, Colorado’s 2023 share ranked 33rd (Rhode Island, 1st: 48.9%; West Virginia, 48th: 10.2%).

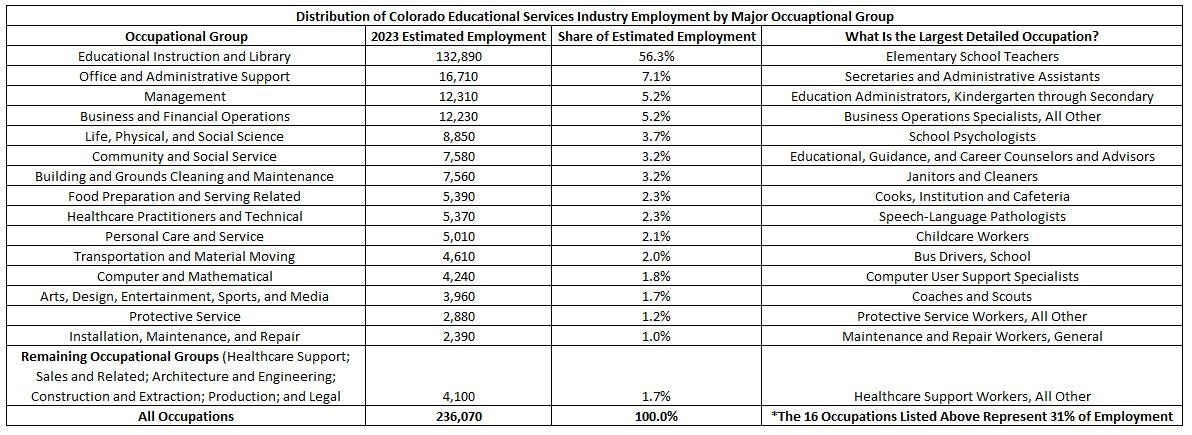

Unsurprisingly, the educational instruction and library occupational group, which is primarily populated with teachers, makes up the bulk of occupational employment within Colorado’s education sector. As the following table shows, this occupational group represented approximately 56%, or 133,000 jobs, of the state’s 2023 total industry employment in education. The remaining share of employment is distributed between occupational groups that can be generally categorized as focused on educational administration, clerical duties, or operational support (e.g. cafeteria staff, bus drivers, afterschool workers, nurses, counselors, accountants, etc.). Estimated employment levels and respective shares for each occupational group are displayed in the table, while the far right column provides select information on detailed occupations.

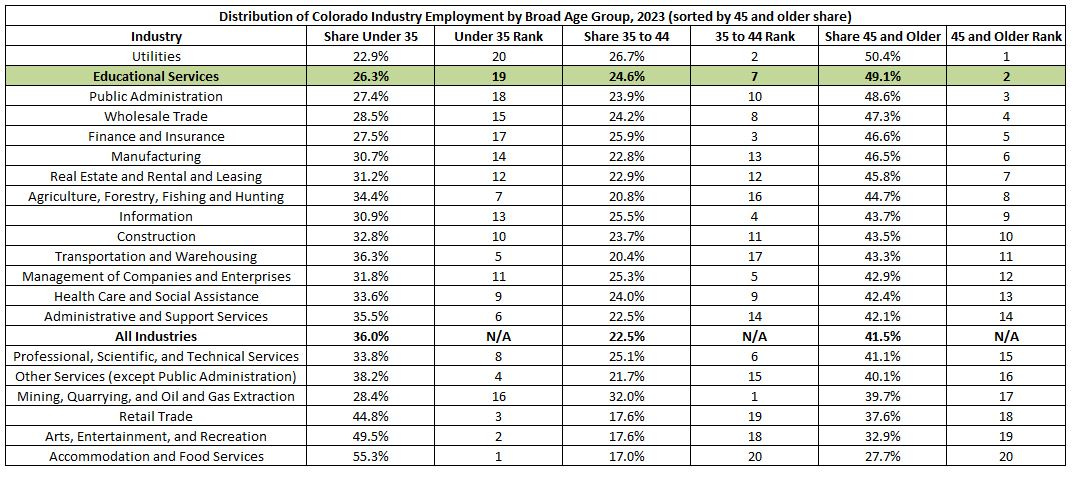

Demographically, the age of workers within Colorado’s educational services sector skews older than most industries. Just under half (49.1%) of individuals employed in the state’s education industry are 45 years or older. That ratio trails only utilities (50.4%) when compared to the other 19 sectors in Colorado. At a detailed industry level, elementary and secondary schools and junior colleges in Colorado consist of more than half their workers over the age of 44. Notably, education has the highest state share of employment (24.4%) between the ages of 45 and 54 compared to other industries. On the other side, slightly more than a quarter (26.3%) of Colorado’s education workers are under the age of 35, in stark contrast to accommodation and food services, which owns the largest share of employing these younger individuals at 55.3%.

Based on data from 2023, nearly 69% of workers in Colorado’s education industry were female. This is the second highest sector share in the state behind healthcare and social assistance and 20 percentage points higher than the average for all industries (48.2%). However, within education there are some noteworthy differences. For instance, the female employment ratio for Colorado elementary and secondary schools was 74.4% in 2023, while colleges, universities, and professional schools had a lower share at 57.5%. These discrepancies are somewhat aligned with national data that shows that postsecondary teachers are slightly more likely to be male, compared to every other education occupation that is majority female (similar data is not available at the state level).

Part II: Employment Trends for Colorado’s Education Industry

Historically, employment within Colorado’s education industry grows at a linear rate, albeit with pronounced dips and surges that coincide with the typical seasonal patterns of the school year. However, this growth was substantially disrupted in 2020 during the pandemic, as schools shut down that spring and shifted to a remote/on-line learning environment. The panel below presents the change in employment levels for Colorado’s educational services industry from January 2012 to October 2024. Employment declines during the height of the pandemic are clear, as the number of educational sector jobs in July 2020 dropped by 8% (or 18,700) compared to the same month a year prior. By September, which typically marks the beginning of a new school year, total education employment in Colorado had decreased by 9.5% (or 25,300 jobs) on an over-the-year basis. In the following four years, educational services employment in the state has gradually recovered, as October 2024 levels were 8.7% higher than in October 2019.

In order to get a better sense of the loss and recovery within Colorado’s education industry, the next chart measures and compares the percent change in employment since October 2012. What likely stands out is how local government educational employment growth significantly lags private sector and state government gains before and after the pandemic. Between 2012 and 2019, employment levels grew around 23% for both state government and private sector education, compared to 11% for local government education. Through October 2024 the difference in employment growth has expanded. Private sector and state government education have experienced rapid increases in employment since 2022, with 12-year growth rates of 45% and 37%, respectively. Local government educational employment, on the other hand, has changed at a much slower pace post-pandemic and grown by only 17% over the past dozen years.

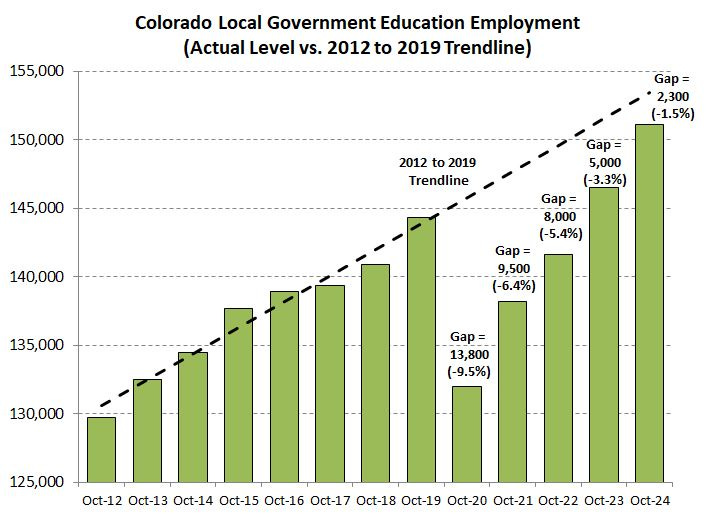

To further illustrate the relatively lackluster recovery in Colorado’s local government educational sector, it’s useful to also compare actual employment levels to those based on a pre-pandemic trendline. While the number of local government education jobs has increased by 4.7% between October 2019 and October 2024, current employment levels fall short of expected levels based on growth trends prior to 2020. As displayed in the graphic below, there is a gap of 2,300 jobs (or -1.5%) between employment reported for October 2024 and the estimated level utilizing the 2012 to 2019 trendline. Colorado’s employment gap of -1.5% ranked 36th nationally when compared to the calculated differences for 47 other states with usable data. However, on a positive note, the state’s local education employment deficit has vastly improved since 2020, when it was at 13,800 jobs, or -9.5%, and levels should likely return to their pre-pandemic trendline either next year or in 2026.

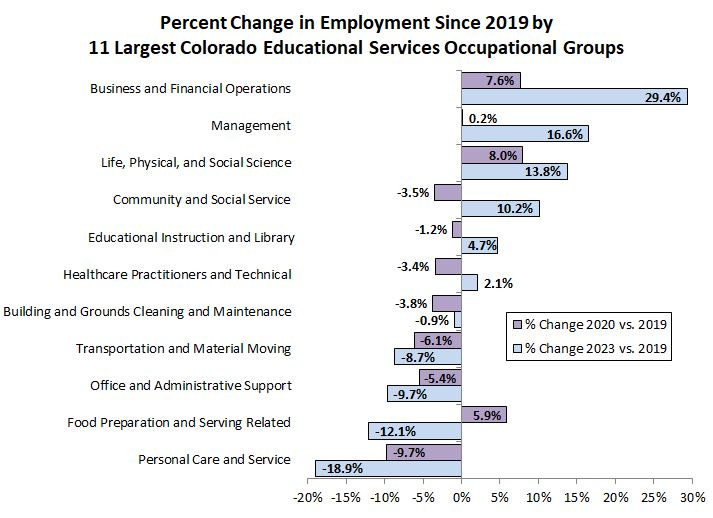

Once again, analyzing occupational trends can be helpful in understanding these pandemic-induced employment shifts within the state’s education industry. The following chart looks at 11 largest occupational groups in Colorado’s educational services sector and their employment changes compared to 2019. The purple bar measures the percent change in employment between 2019 and 2020, while the blue bar is the change from 2019 to 2023. Seven of the 11 occupational groups experienced employment declines in 2020, with those losses ranging between -1.2% (educational instruction and library) to -9.7% (personal care and service). Moving forward to 2023 reveals a fairly even split in occupational groups with employment gains (6) and decreases (5) compared to 2019. The occupational groups with the largest percent increases over that four year period were business and financial operations (+29.4%) and management (+16.6%). While a positive figure, employment growth for the educational instruction and library occupational group rose by less than 5% between 2019 and 2023. Four occupational groups are still experiencing significant job loss within the educational sector since 2019: personal care and service (-18.9%); food preparation and serving related (-12.1%); office and administrative support (-9.7%); and transportation and material moving (-8.7%). Additionally, all four of those occupational groups, which specialize in jobs like afterschool care, cafeteria service, clerical assistance, and bus drivers, have accelerated rates of decline in 2023 compared to 2020, indicating a prolonged impact.

Part III: Wage Characteristics and Trends for Colorado’s Education Industry

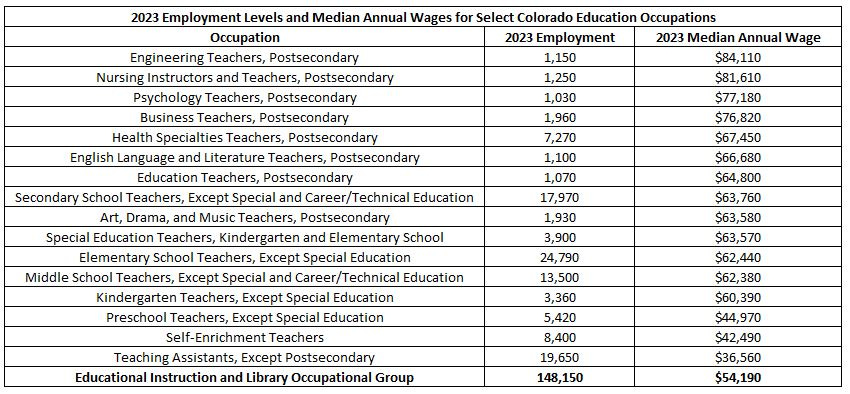

This next section will transition to discussing wage characteristics and trends for Colorado’s educational services industry. Given that the majority of educational employment is concentrated within teaching jobs, most of the following analysis will focus on that occupational subset. In 2023, the median annual wage for workers in Colorado’s educational instruction and library occupational group was $54,190. As demonstrated in the table below, these wages vary greatly at a detailed occupational level, with postsecondary teaching positions generally earning more annually than their K-12 counterparts.

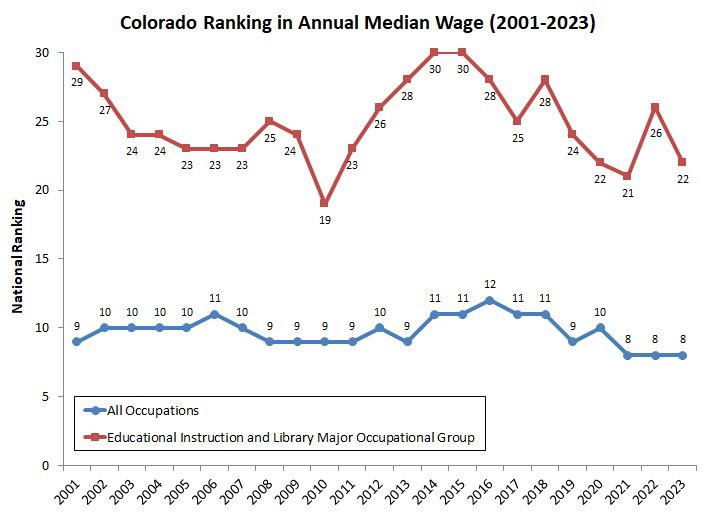

Similar to construction, Colorado’s educational instruction and library occupational group pays median wages that rank relatively low nationally in comparison to the state’s median earnings for all occupations. Between 2001 and 2023, median wages for the educational group ranked between 19th and 30th compared to all other states (the worst long-run ranking of any of Colorado’s 22 major occupational groups). In contrast, median wages for all occupations have ranked no worse than 12th over that 23-year period, helping to support the claim that Colorado is a high-paying state.

At $54,190, the educational instruction and library occupational group median annual wage in 2023 is nearly identical to the median earnings for all occupations in Colorado ($54,050). The percent difference in the median wage between those two occupational categories has narrowed greatly over the past eight years, from 23.0% in 2015 to 0.3% in 2023 (the smallest differential of any state). The shift over that period is likely due to a combination of rapid wage gains for lower-paying occupations and relatively slow wage growth for education occupations. Looking at substate Colorado reveals a similar lack of comparative wage advantage for education occupations. Compared to 532 total areas across the nation, the Fort Collins MSA is the only Colorado substate area with a rank better than 400th when calculating the 2023 median wage differential between the broad education occupational group and all occupations. The differentials for Colorado’s other nine substate areas rank in the bottom fifth nationally and are well below the U.S. difference of 24.6%. These low ranks across the state indicate that education is struggling to keep up with wage increases experienced other jobs. For instance, the median wage for the educational instruction and library occupational group grew by 20% between 2015 and 2023, which is substantially lower than the 47% change for all occupations.

While there have been recent legislative efforts to modify school funding in Colorado, there is uncertainty regarding the timing of the rollout, enrollment trends, and the impact of school closures. That said, employee pay within Colorado’s education industry will remain an issue for the foreseeable future for a number of reasons. First, the allocation of relatively older workers within the education sector means a greater concentration of individuals at peak earning years (generally, median income in Colorado and the U.S. is highest between the ages of 45 and 54). Second, attracting and retaining teaching staff (particularly younger individuals) may continue to be difficult due to the increasingly low wages offered relative to other occupational groups and by other states. The profession typically requires at least a bachelor’s degree in order to teach, and the rising cost of college education (and subsequent salary compensation) is likely going to be a crucial factor in one’s decision of whether to seek employment in Colorado. Third, as previously mentioned, while the state is improving on pandemic employment losses within the education industry, there are several important operational support occupations that continue to experience job declines (e.g. afterschool care, cafeteria service, clerical assistance, and bus drivers). Interestingly, funding may be the cause for the lack of job recovery within those positions, as the education industry tends to pay those occupational groups a higher median salary compared to all industries within Colorado. However, it should be noted that management jobs within education (which paid annual median wages around $100,000 in 2023) have risen by a meaningful amount since the pandemic. Finally, due to some of the constraints and factors referenced above, Colorado will likely see a continued increase in the share of educational industry employment that shifts towards the private sector. Based on current trends, it’s reasonable to assume that the private sector will represent between 20-25% of Colorado’s total educational services employment by the end of the decade.

Ryan, thanks for this work. A couple of things strike me. First, predicting impact of AI on this occupational category will be timely. Even if data center/LLM investment by big tech is overblown, the pace of improvement in technologies like ChatGPT means it will augment or replace more and more of the jobs in categories like this one. Second, future growth in these categories may otherwise largely depend on Colorado's school-age population growth, which for a range of reasons looks to be substantially less in the future than in the recent past. That's already showing up in forecasts for e.g. DPS' enrollment. The sector *could* address this if for example our post secondary institutions adopted aggressive growth strategies (as for example ASU has done, becoming a national platform for life-long learners) -- but there's no evidence they're going to do so...