A Look Back at Colorado’s Job Growth Performance in 2024

The state added only 14,700 jobs last year, a steep drop-off compared to 2023

Last week the Bureau of Labor Statistics (BLS) released new Quarterly Census of Employment and Wages (QCEW) for the 4th quarter of 2024, meaning that annual employment data for last year was also available for all states. The QCEW data can be cumbersome to compile and analyze, but never fear, the Stat Guy is here. This article will quickly highlight six charts and two tables that illustrate Colorado’s relatively weak job growth in 2024.

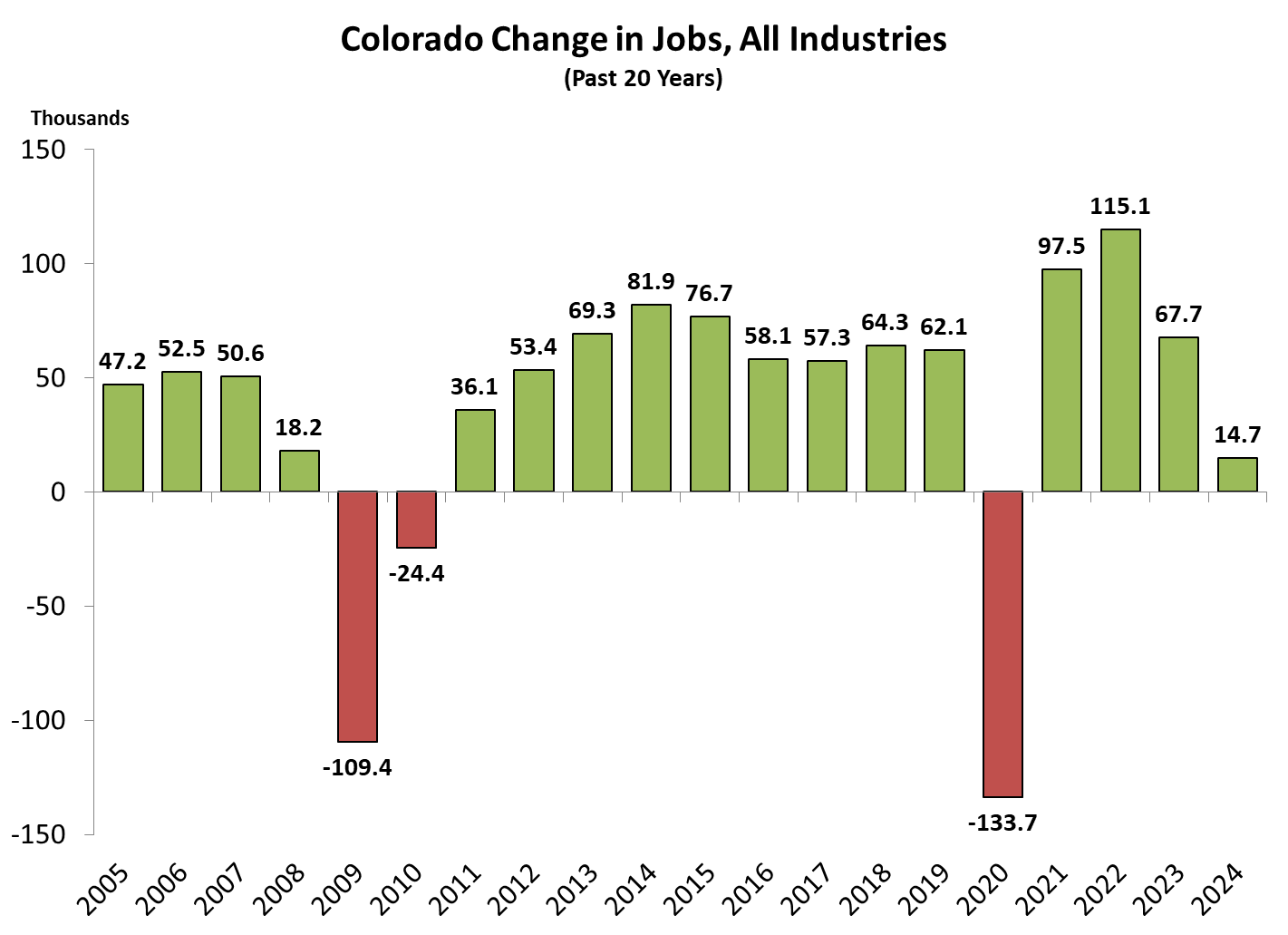

As shown in the first chart, Colorado added only 14,700 jobs last year, a steep drop-off compared to an increase of nearly 68,000 in 2023. Over the last 20 years that is the lowest gain in the number of jobs for the state in a non-recessionary year (bars shown in green).

The change in jobs on a year-over-year basis can be converted to growth rates, which are displayed in the following chart. The solid, dark blue bars represent years in which Colorado’s QCEW job growth was at least 1.5%, and the pixelated bars are years that fell below that mark (2008-2010, 2020, and 2024). While 2008-11 (Great Recession) and 2020 (Pandemic Recession) overlap with known U.S. recessions, Colorado’s relatively weak growth rate of 0.5% in 2024 occurred during an expansionary period for the nation. In 2023 the state’s growth rate was 2.4%, very similar to the years leading up to the pandemic.

One way to isolate drivers of Colorado’s weak job growth in 2024 is to look at trends by ownership type. Simply, ownership type can be separated four ways: federal government, state government, local government, and the private sector. The next chart shows the change in Colorado jobs for 2023 and 2024 by ownership type (federal government = blue bar; state government = red bar; local government = green bar; and private sector = purple bar). Federal government jobs in Colorado grew by 1,900 in both 2023 and 2024, so that ownership type had no effect on the state’s relatively weak job growth last year. State government employment gains slowed slightly in 2024 (2,900 vs. 3,800), while the difference in local government was more notable (7,100 vs. 13,500). However, Colorado’s private sector experienced a massive shift in job growth last year, registering only 2,800 jobs added compared to a change of nearly 50,000 in 2023.

Mirroring a prior chart, Colorado’s private sector job growth over the past 20 years is presented below. The state’s private sector growth rate of 0.1% stands out as historically weak, trailing only 2009, 2010, and 2020. Job growth in 2023 was 2%, marking the 15th time since 2005 Colorado’s private sector reached that threshold.

When breaking out Colorado’s year-over-year private sector job growth over the past eight quarters, two significant shifts become quickly obvious. First, the change in the growth rate between the fourth quarter of 2023 (1.9%) and the first quarter of 2024 (0.4%) represented a rapid slowdown for the state. Second, job growth for the fourth quarter of 2024 turned negative (-0.7%), meaning job loss, rather than relatively slow job gains.

The final chart shows how Colorado’s QCEW private sector job growth ranks compared to all other states over the past 20 years. In 2024 the state’s growth rate of 0.1% ranked 45th nationally (tied with Washington and Iowa) and only lead Illinois (0.0%), Oregon (-0.1%), and Massachusetts (-0.2%). The rank of 45th last year matched Colorado’s relatively weak national performance in private sector job growth from 2010; however, the U.S. was deep in a lengthy recession at that point. 2009 and, notably, 2023 were the only other years over the past 20 years in which Colorado’s private sector job growth ranked worse than 20th.

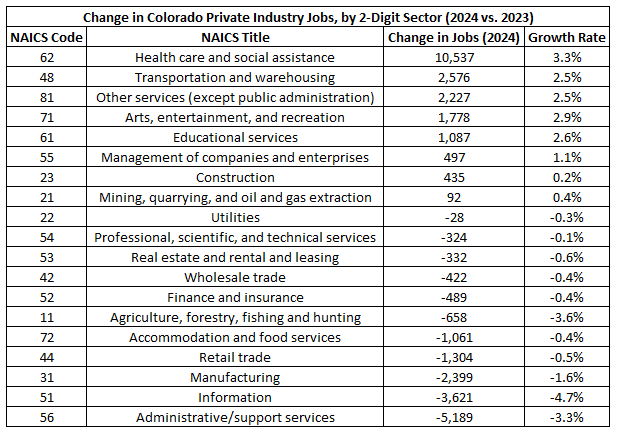

To further understand the drivers behind Colorado’s weak private sector job growth in 2024, it’s important to look at the different industry sectors within the state. The table below displays the nineteen 2-digit NAICS industry sectors in Colorado with private employment. The third column in the table shows the change in the number of jobs for each industry sector in 2024, while the fourth column represents the related growth rate. Private health care and social assistance clearly added the most jobs last year (10,537) and was the only industry with gains exceeding 3,000. Job loss, however, occurred in 11 of the 19 industry sectors, led by administrative/support services (-5,189). Accommodation and food services (-1,061), retail trade (-1,304), manufacturing (-2,399), and information (-3,621) all experienced employment declines of at least 1,000 last year. Professional, scientific, and technical services, long a key driver for Colorado job growth, lost jobs in 2024, marking the first time that has happened since 2010.

Finally, a strength of the QCEW data is the ability to analyze more granular level of industry detail available than other BLS employment series. The next table digs deeper into industries with employment declines last year, specifically looking at the 16 detailed (4-digit NAICS) Colorado industries that shed at least 600 jobs in 2024. The first three columns of the table identify information about how each of the 16 industries is classified, while the fourth column shows how much employment declined for each of those industries in 2024. Overall, job loss between these industries was spread through multiple broad sectors of the state, touching retail trade, manufacturing, tech, finance and insurance, restaurants, and more. Employment services and computer systems designs and related services each lost over 3,000 jobs last year. Combined, these 16 detailed industries shed over 23,000 jobs in 2024.

Note: Late last year the BLS temporarily suspended the publication of Colorado’s QCEW data, but announced the resumption of that data publication in February. While the specific reasons for these series of decisions are unknown, the analysis contained within article is treating all 2024 QCEW data for Colorado as an accurate representation of the state’s labor market and related job growth, since “quality concerns with Colorado data have been sufficiently addressed”, per the BLS. That said, there are atypical shifts in the number of Colorado establishments over the past year. For instance, private sector establishments in Colorado dropped from 256,379 in the fourth quarter of 2023 to 232,818 in the fourth quarter of 2024, a decline of 9.2%. It’s unknown if economic factors are causing that change.